AboutFacts About Top Industries In Need Of Commercial Auto Coverage ... Uncovered

"Many service owners make the mistake of thinking all insurance policy service providers are the exact same and only concentrate on cost. While rate is absolutely part of the equation, company owner should examine independent surveys or on-line review websites to see how well they perform when it counts," Hynek says. Service Insurance Made Straightforward Contrast Complimentary Quotes From Leading Insurance Firms at Merely, Business.

Implementing these suggestions does not assure insurance coverage. If any kind of plan protection summaries in this write-up dispute with the language in the policy, the language in the plan uses. For complete information on Grange's service insurance policy, insurance coverages and discounts, call your local independent representative. Resources:.

If you're taking into consideration auto insurance protection for your business, it is very important to comprehend the standard aspects of a business vehicle plan. The even more you understand, the less complicated it is to compare insurance coverage as well as make an informed option. Commercial auto insurance coverage meaning Commercial auto insurance coverage offers a selection of protections for vehicles, trucks, vans as well as various other vehicles made use of by your company.

How Commercial Vs. Personal Auto Insurance - What's The ... can Save You Time, Stress, and Money.

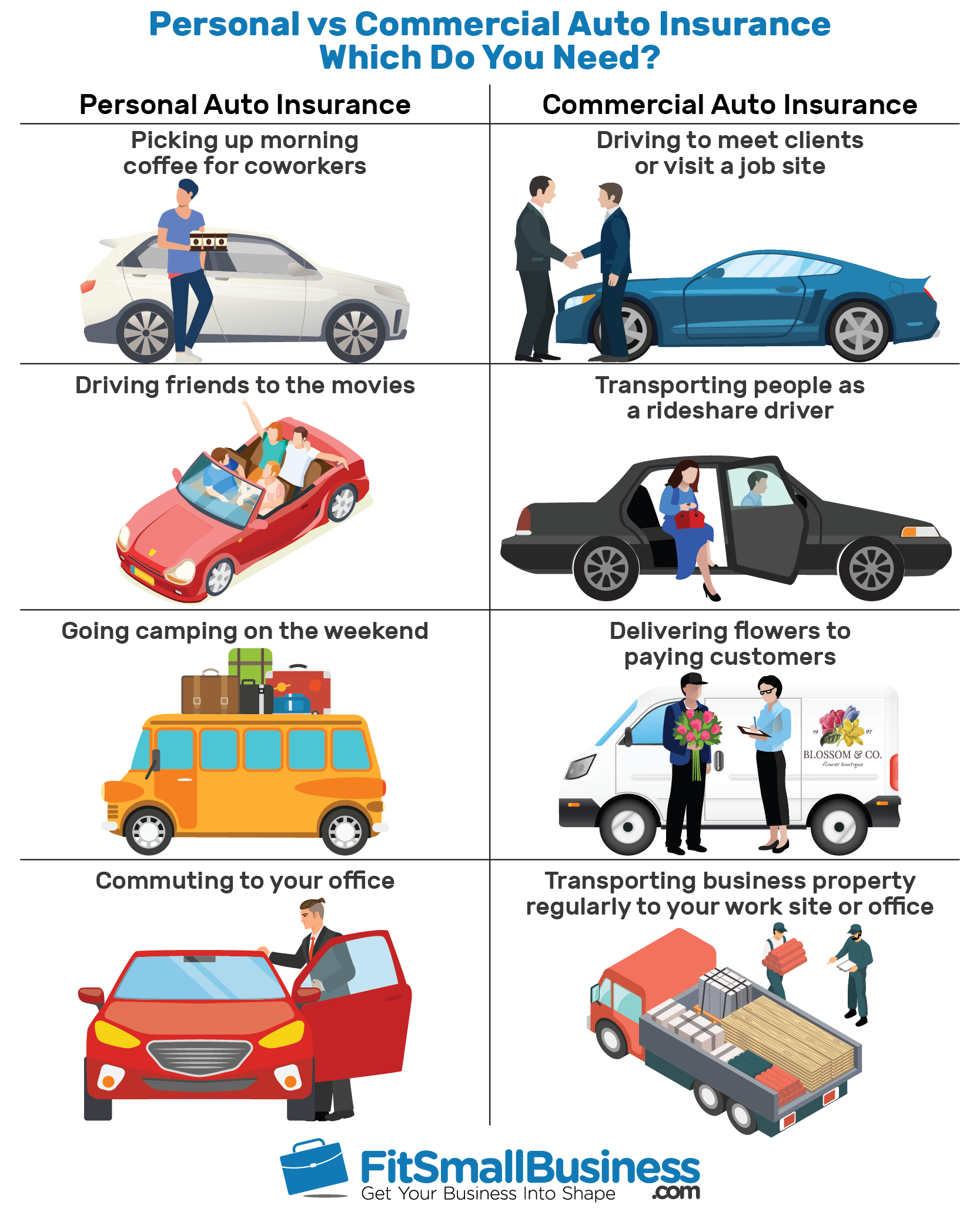

For numerous firms specifically local business it might not constantly be clear what kinds of autos are taken into consideration "individual" and which ones are considered to be "business" lorries. Component of the reason for this is that firm proprietors and employees periodically use personal autos for job-related objectives. Nevertheless, personal and also business vehicle insurance does not supply the exact same kind of coverage.

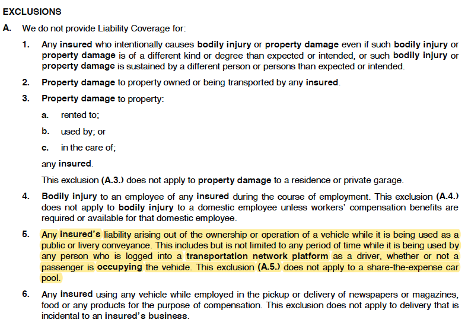

It is critical that organizations acquire insurance protection for every one of its vehicles. It is also essential to recognize that individual and also business auto insurance plan normally provide various types of insurance coverage. Right here are four notable methods which these two sorts of insurance coverage vary. Liability Insurance coverage Businesses typically face numerous kinds of possible obligations.

In the last case, the insured event would certainly be an organization. However, it must be noted that an industrial insurance plan can have numerous names noted on it. Just named insured drivers may make any adjustments to a car insurance coverage policy, as well as a called insured driver might not be removed from a policy without approval.

Get This Report about What Is Commercial Auto Insurance? - Policygenius

THURSDAY, AUGUST 13, 2020 The majority of drivers with an individual lorry bring individual auto insurance policy in order to secure their assets in case of a crash. Not all lorries are individual automobiles, nevertheless, as well as personal vehicle insurance coverage isn't the only alternative. Business automobiles are automobiles had or utilized by a business for work functions.

Some automobiles are produced industrial usage, such as eighteen wheelers, vans, buses, etc. Other cars are made for individual use but can be used for organization, such as business cars and trucks. The main difference between these two cars is exactly how they are used and the insurance coverage they require. What is Commercial Auto Insurance? Commercial auto insurance is a plan especially geared to cover business automobiles.

: Collision coverage gives compensation for damages to the automobile because of collision with an additional lorry or object.: Liability insurance covers bodily injury as well as property damages a chauffeur might trigger while running the insured vehicle.: Medical repayments coverage offers payment for the driver's and passengers' clinical expenditures, regardless of that causes the crash.

Commercial Auto Insurance For Business Vehicles - Paychex Can Be Fun For Everyone

Do I Required Commercial Automobile Insurance Coverage or Individual Car Insurance? On the other hand, commercial automobile insurance policy can cover individual use however has to just be made use of on work automobiles.

If you regularly utilize a work automobile or individual automobile to transportation tools or items, you might need business vehicle insurance policy. Remember that your insurance carrier can terminate your policy if they discover that your personal automobile is guaranteed with business car insurance yet is not being utilized for job, as well as the other way around.

What Is Business Lorry Insurance? As a businessowner, you need several of the very same insurance coverage coverages for the cars and trucks, trucks, vans or other cars you utilize in your organization as you do for cars utilized for personal traveling. Your Businessowners Policy (BOP) does not provide any type of protection for automobiles, so you have to have a different plan.

The Main Principles Of What Is Commercial Auto Insurance? – Nationwide

A personal car plan is not likely to give insurance coverage, nevertheless, if the vehicle in concern is made use of largely in organization. It will certainly not give insurance coverage for any kind of lorry owned by an organization. The individual vehicle plan, whether yours or your staff member's, may not have enough protection to safeguard your business.

The chauffeur and also five travelers are wounded in the crash. If you have just an individual automobile policy, your insurance provider will most likely protect you personally and pay the claimup to the policy limit.

As a whole, you have 3 options for which cars you pick to cover. Vehicles your company possesses All autos your organization owns, works with or rents All autos used for the business, including those that your company does not own, employ or rent A lot of organizations ought to purchase the third type, since that is the only insurance coverage that secures business from obligation when a worker or proprietor is driving a personal car on business.

What Does How Much Does Commercial Auto Insurance Cost? - Get Quotes Mean?

https://www.youtube.com/embed/6DwUl7ZLJyY

In the occasion of a failure, the ACV is readjusted for depreciation and the car's physical problem. Therefore, the older the lorry as well as the even worse its condition, the a lot more its value has depreciated and also the less the insurance provider will pay. The insurance business may pay you the value of the loss in cash or, at its selection, it might fix or change the damaged or taken car.