AboutSome Known Facts About Is California A No-fault State? - The Ryan Law Group.

In no-fault states, drivers are made up by their own insurer for injuries after accidents, no issue that created the collision. No-fault car insurance covers your clinical bills after a mishap, whether you caused the crash or otherwise. If no-fault insurance coverage does not seem familiar, accident defense might. That's what this kind of vehicle protection is called in the majority of no-fault states.

Vehicle drivers in choice no-fault insurance policy states can deny the constraint of their right to file a claim against for problems after a crash. How does no-fault insurance work? In a no-fault state, you submit insurance claims to your very own insurance firm.

In Utah, your clinical costs need to cover $3,000 before you can take legal action against a person for pain and also suffering. Just how much is no-fault insurance policy? What you spend for no-fault insurance depends on several factors, consisting of where you live, where you get it and also how much insurance coverage you get. That last rate variable is especially important, as some no-fault states require vehicle drivers to purchase simply $5,000 or $10,000 of PIP protection, while others call for insurance coverage of $40,000, $50,000 or even more.

Little Known Facts About Is California A No-fault State For Auto Insurance?.

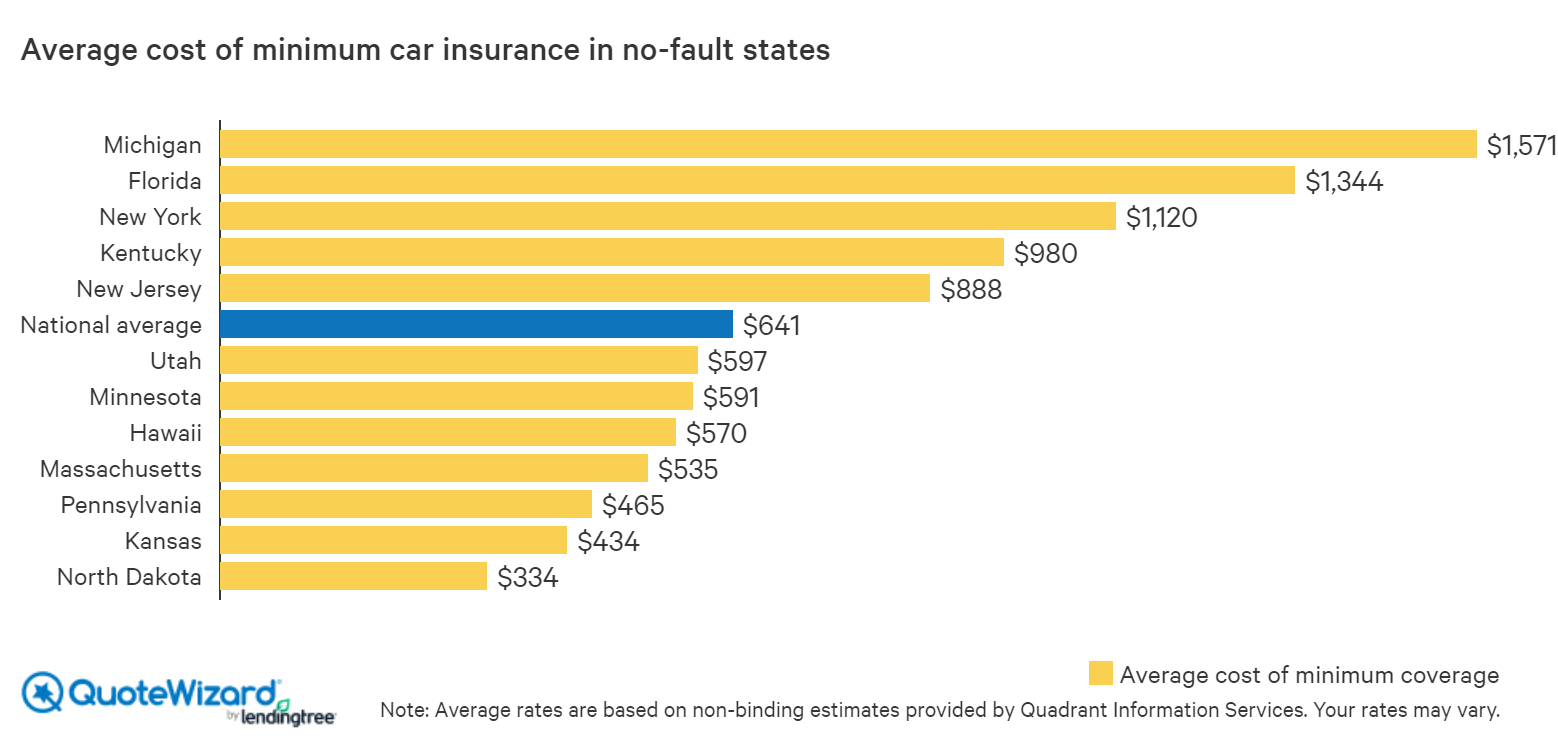

Chauffeurs in some no-fault states pay a whole lot a lot more for vehicle insurance coverage than they would certainly if they lived someplace else. The national standard for minimum-coverage auto insurance coverage is $641 per year, according to our data.

The ordinary price of state-minimum coverage in the least expensive place, North Dakota, is nearly half the nationwide average, at $334 annually. The very same holds true when you consider the price of full-coverage car insurance policy in no-fault states. In five no-fault states, the typical cost of a full-coverage policy is much more costly than the nationwide standard.

That's $1,116 each year more than the national average for this sort of policy or virtually increase the quantity. Motorists in Massachusetts, though, invest a standard of $823 annually on full-coverage car insurance policy. That's $432 per year less costly than the nationwide average despite the fact that the state has a no-fault law on the publications.

If you live in Kentucky, you can turn down PIP protection for yourself. In many scenarios, however, you'll still need to get "guest PIP" coverage for travelers and pedestrians. Likewise, not all states or insurers call this protection injury security. As an example, Kentucky refers to it as standard adjustments advantages, in addition to PIP.

What Does Faq: What Does No-fault Mean? - Sand Law, Llc Do?

LLC has made every effort to make certain that the info on this site is proper, yet we can not ensure that it is complimentary of mistakes, mistakes, or omissions. All web content and solutions provided on or with this website are offered "as is" and also "as available" for usage.

One of the most misinterpreted ideas in the insurance coverage globe is the concept of no-fault coverage. If you reside in one of 12 no-fault states, this principle may have influenced you if you have actually made a claim on your car insurance policy. Merely placed, no-fault insurance coverage claims you can make an insurance claim to your insurance policy company for clinical as well as various other expenses following a mishap, despite whose fault the accident was.

No-fault insurance simplifies the process. What is no-fault insurance?

No-fault coverage is aimed at rapidly paying insurance claims for injury. However there's even more to it than that: you additionally won't have to take the other driver to court. Actually, your capacity to file a claim against may be limited. No-fault coverage was created to lower the expense of vehicle insurance policy by keeping smaller-dollar cases out of the courts.

The 2-Minute Rule for Is California A No-fault State For Auto Insurance?

If you're included in an automobile crash and bring no-fault insurance policy, you'll be covered for your very own medical costs as well as shed pay. Some no-fault states limit the quantity of cash you can collect from your car insurer, while others do not. The part of your plan that covers these prices is called accident security, or PIP.

In many cases, for instance, if injuries are incurred by a home owner, PIP may cover family jobs Here are a few of the expenses that PIP will not cover in a no-fault state: The other vehicle driver's insurance policy ought to cover these. If you are a pedestrian and are hit by a car, your PIP will cover you.

In some states, you might be able to file a claim against the various other chauffeur for prices over your insurance coverage if the accident is their mistake., it will certainly cover damages caused by a crash.

https://www.youtube.com/embed/Fpy6B8Jv7uw

Who spends for vehicle damage in a no-fault state? If you carry optional accident and also extensive coverage, these policies will certainly spend for car damage no matter who's at mistake.