AboutThe Best Guide To Az's Sr-22 Insurance Specialists - Aall Insurance

The best point that you can do to protect an affordable rate is to look around and also contrast quotes. Also risky insurers will offer various rates depending on your scenarios. You will find the very best price by accumulating a couple of different quotes and also contrasting them. What are the various state regulations around SR-22s? While the majority of states utilize an SR-22 filing as assurance that you are covered, not every one of them follow this technique.

It is essential to note that, if you move out-of-state while under this limitation, you will still be subject to the SR-22 demands of the state where your driving event occurred. You will certainly still have to keep your SR-22 declare as long as is mandated, also if your new state does not need such protection.

What Is Sr22 Car Insurance & How Does It Work ... Can Be Fun For Everyone

Often asked questions, Just how a lot does an SR-22 expense? Typically, the price of an SR-22 is about $25. However, the actual cost differs based on the state as well as the insurer that is supplying your SR-22. For how long do I need to have an SR-22? If you need to get an SR-22, it will certainly not get on your document forever.

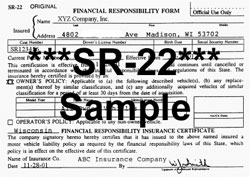

You might have been requested an SR22 type in the past, and not been exactly sure what it is, why you need one, or just how to get this certificate. Thankfully, we are mosting likely to answer every one of those questions for you and also more! An SR22 is a kind of accreditation that is commonly called for by the state to state monetary duty; specifically when a person without liability coverage was involved in a mishap or is otherwise found to be without legal degrees of called for insurance coverage.

What Does What's An Sr-22 - Infinity https://canvas.instructure.com/eportfolios/154093/comprehensivecarinsurancerdei610/Fascination_About_Sr22__Car_Insurance_Quotes__Freeway_Insurance Insurance Mean?

If you were caught speeding or drew over for any type of factor and also were unable to show proof of present insurance coverage, then you will certainly need an SR22. There are likewise a couple of various other situations where the state requires this vital file: Anytime you are associated with a mishap without insurance coverage that was determined to be your fault When you receive way too many web traffic offenses in a short amount of time You are captured driving on a put on hold or withdrawed license You are included in any kind of sort of severe moving infraction, such as DWI or DRUNK DRIVING While different states have different cost needs, in basic, many companies charge extra costs for SR22s.

/driver-s-licence-172134558-bd62d5798d6a4d2ca427c61eecaf5ce8.jpg)

If you're thought about a risky chauffeur such as one that's been founded guilty of numerous traffic violations or has actually received a DUI you'll most likely need to end up being accustomed to an SR-22. What is an SR-22? An SR-22 is a certificate of economic obligation needed for some chauffeurs by their state or court order.

The Definitive Guide to What's An Sr-22 - Infinity Insurance

Depending on your circumstance and also what state you live in, an FR-44 may take the location of the SR-22. Just how does an SR-22 work?

1 It depends on your cars and truck insurance provider to submit an SR-22 kind for you. You may be able to include this onto a current policy, but bear in mind that not every automobile insurer agrees to give SR-22 insurance. In this instance, you'll need to look for a brand-new policy.

9 Simple Techniques For Best Sr-22 Car Insurance Companies - Clearsurance

On top of that, submitting an SR-22 is a vital action in acquiring a challenge or probationary permit. 3 Exactly how long will you need to have it? In the majority of states, an SR-22 is required for 3 years, but you should call your state's DMV to discover out the precisely how much time you'll require it.

You might even have to start the SR-22 procedure all over again. Try to recognize any various other parameters that control your SR-22.

The 6-Minute Rule for Non-owner Sr-22 Insurance Explained ...

3 The declaring treatments for the SR-22 and also FR-44 are similar in several ways. Some of the main points they share include4,5,6: FR-44s are usually called for via court order, or you can verify your demand for one by calling your local DMV. Your automobile insurer will certainly file your FR-44 in your place with the state's automobile authority.

https://www.youtube.com/embed/AM1zkCh9Jt4

For context, the minimal liability protection for a typical chauffeur is just $10,000 for physical injury or death of someone. 7 Where to get an SR-22 If you believe you need an SR-22, talk to an insurance policy representative. They'll be able to lead you via the entire SR-22 declaring process as well as make certain you're meeting your state's insurance coverage policies.