The Greatest Guide To Renters Insurance

It's not expensive. And it ought to't take more than a few mins to get. That's why we have actually produced this guide to help you determine the process, obtain the momentum back in your corner, and really feel safe in your house knowing that your residential or commercial property is secured - lease. What Is Renters Insurance? In the most easiest terms, tenants insurance results in a money payment to you if your property is lost or ruined.

It's not much various than various other insurance coverage because it safeguards you from needing to pay substantial amounts of money out-of-pocket to change all your belongings. The difference that its "tenants" insurance coverage simply implies that what's covered is only the worth of your items (furniture, electronics, garments, fashion jewelry, etc) and not the physical structure.

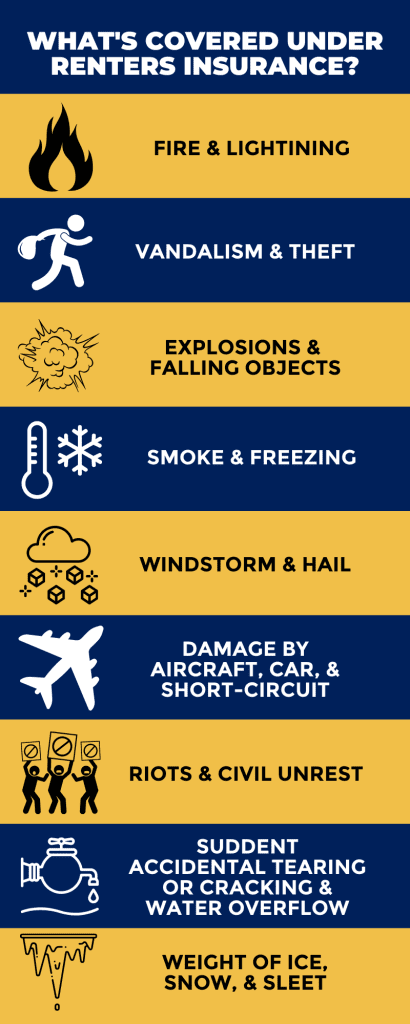

Don't be too worried concerning that though, because usually the called dangers are the kinds of occasions you are probably to face as an occupant. Tenants insurance coverage also covers you for obligation matches that may develop if a visitor in your house injures themselves. You never ever know when a visitor might trip over a furniture as well as damage a leg. low cost.

affordable coverage landlord bundle renters insurance rental

affordable coverage landlord bundle renters insurance rental

What Are Costs as well as Deductibles? The premiums are what you pay for the insurance policy (generally monthly, yet can be every 6 months and even annual) - renter's. It's merely the price of the policy as well as is established based upon what dangers are covered, the worth of your possessions, and also just how much obligation coverage you want.

Many tenants elect to have an insurance deductible in a quantity that they find workable to cover at a minute's notice, one that wouldn't "break the bank". Do I Need Renters Insurance Policy? Opportunities are you can't, would not want to, bundle and would profit from the protection that occupants insurance brings. affordable renters insurance.

The Definitive Guide to Apartments & Renters Insurance Policies

Surprisingly enough, we found that almost fifty percent of all renters do not obtain insurance policy. Landlord insurance policies do not cover your individual residential or commercial property as well as the property owner does not have an insurable rate of interest on your properties (he doesn't have them, consequently can not guarantee them).

Most property managers try to make this really clear to their occupants since numerous tenants incorrectly believe they are covered by their property owners' insurance coverage. A lot of lease agreements call for that you buy as well as preserve renters insurance policy, commonly presuming regarding need you to offer evidence of such, including the sort of protection, its limits and its expiration. home insurance.

Most tenants insurance policy will cover your personal building regardless of where it's situated. One of our founders, Ryan, had his automobile broken into in Silicon Valley with thousands of bucks worth of stuff swiped - affordable renter's insurance. It had not been his auto insurance policy that covered his swiped home; it was his tenants insurance coverage.

You can inspect your State's department of insurance to make certain they're accredited as well as have done all their filings - vehicle insurance. You can also examine J.D. Power, A.M. Ideal and the Bbb to see how the companies stack up versus each other. What is necessary is to ensure the company has the economic standing to be able to pay any insurance claims you have actually made, as well as the background to show that they DO pay insurance claims fairly.

renter apartment insurance renter insurance liability vehicle insurance

renter apartment insurance renter insurance liability vehicle insurance

Some suppliers have leaner procedures, less middlemen, etc and can pass those financial savings onto you as the customer. This will certainly typically be shown in the different quotes you receive. However, it is very important to see to it that you're contrasting apples-to-apples below (water damage). Make sure that one plan doesn't simply appear cheaper due to the fact that the premiums are lower.

The 20-Second Trick For What Is Renters Insurance? (For Students) - Cev Ruston

Connect to close friends, associates and relied on resources to see what they suggest. renter's insurance. Often, individuals that have first-hand experiences with their insurance coverage brings, specifically after a claim, can provide you some presence into the provider. Right here, at Obtain, we usually get asked if there's a business we suggest. As a matter of fact there is.

Actual Cash Money Value Vs. Replacement Expense When establishing the kind of policy, you'll elect whether your payout for any kind of claims will be based on real cash worth or on substitute cost.

A computer you paid $1,500 for 3 years earlier may, after devaluation, just result in a payout of $700. The real cash money value is likely not nearly enough to enable you to fully change whatever or at the very least not with the exact same degree of quality as your residential property that was shed, damaged or destroyed (affordable)., on the other hand, is the real cost of replacing your property (devaluation is not factored in right here).

Since the replacement cost kind of plan covers you extra fully, it likewise suggests your costs would be more than the actual money value policy. Nonetheless, this boost is not usually considerable and most renters should choose to pick the replacement expense policy. Property Coverage Restriction You'll want to find out what insurance coverage limit to carry your residential or commercial property (or exactly how much your building deserves).

You can do this on a sheet of paper and amount up all the worths. Do this for your clothing, footwear, electronic devices, furniture, fashion jewelry, and so on. When you reach the end and sum it all together, you'll be amazed. cheapest. Your property is typically worth a whole lot greater than you 'd at first believe.

Top Guidelines Of Plymouth Rock Renters Insurance Quotes And Coverage

This can be significantly more relying on the variety of bedrooms as well as people staying in the system or house. As you're producing your supply list, you should consider also taking images or a video defining the things, when/where you got them and exactly how much you paid for them. This will come in helpful should you need to do a claim in the future.

One essential note below is that there is usually a limitation per single thing, especially around precious jewelry - renters coverage. Most plans will certainly have a $1,000 limit per item of jewelry. If you have jewelry as well as other things that are more than the typical restrictions for a single product, you'll want to consider adding to your plan to cover those details products individually.

A higher property insurance coverage limit will directly enhance the overall costs you pay. Liability Insurance coverage Limitation The common liability protection limitation is for $100,000. This is the protection that begins if a visitor is injured while in your rental home, as well as covers clinical expenses linked with the injury. Claims right here don't normally have a deductible use, whereas insurance claims for damage to property constantly do.

cheapest affordable renters insurance insurance property insurance options

cheapest affordable renters insurance insurance property insurance options

Just how this impacts my costs A higher responsibility protection limit will enhance the complete costs you pay. The Insurance Deductible and Premium Tradeoff As mentioned previously, the insurance deductible is the quantity you'll pay when you submit a claim before the insurance carrier's protection starts. vehicle insurance. An additional means to think of it is your share of the insurance claim.

The deductible is something you can change higher or lower when you're very first creating your plan. Some renters choose to have a greater deductible so that their costs are reduced.

Renters Insurance for Dummies

Exactly how to Obtain the very best Offer on Renters Insurance Coverage There are a few other products that can assist you obtain the best offer and also lower the price of your occupants insurance plan. Below's a fast listing: Request for a smoke detector and fire extinguisher discount rate (affordable renters insurance). If you have these correctly installed/placed in the home, lots of carriers want to use a discount - insurance.

Have a security/alarm system in position that checks for burglary, vandalism, etc. This prevents burglary and also must assist you decrease your regular monthly premiums. There are several business readily available that offer budget-friendly, versatile and also moveable alarm system systems to ensure that you can take the system with you when you leave. Pay your renters insurance expense completely, in advance, instead of in month-to-month installments (property).

Get your auto insurance coverage or other lines of insurance coverage with the exact same firm. There's typically a discount, called a "multiline" price cut for having multiple lines of insurance with the exact same carrier. The added benefit right here is that with a firm like State Farm, you'll also be building a relationship with an agent that can supply even more than just insurance choices.

renters apartment insurance vehicle insurance cheaper renter's

renters apartment insurance vehicle insurance cheaper renter's

Is all my stuff covered? What perils are covered? What takes place if someone gets hurt in the home? Does the plan cover all roommates? Is my pet covered, too? Just how much will the plan cost? These are all the essentials. If you have much more certain questions or demands, check out even more information right here.

https://www.youtube.com/embed/3Eu-uVceivY

Occupants locate the software user-friendly, user-friendly as well as enjoy the transparency that Avail brings to the rental process. price.